Real Estate Financial Investment in New York State: A Comprehensive Guide

Purchasing property in New york city State uses varied possibilities across its vivid metropolitan facilities, attractive suburban areas, and calm backwoods. Whether you're attracted to the dynamic roads of New York City or the tranquility of the Hudson Valley, comprehending the market dynamics and investment potential is crucial. In this overview, we will certainly check out why New york city State is an appealing location for real estate financial investment, key regions to consider, and crucial suggestions for success in this vibrant market.

Why Invest in Realty in New York State?

1. Economic Resilience and Diversity:

New york city State flaunts a diverse economic climate driven by sectors such as finance, modern technology, healthcare, and tourism. This financial strength translates into security genuine estate investments, with constant need across household, industrial, and mixed-use buildings.

2. High Rental Demand and Returns:

Cities like New York City, Buffalo, Rochester, and Albany experience solid rental need due to their large populaces, universities, and job possibilities. Financiers can benefit from affordable rental returns, especially in neighborhoods with minimal real estate supply and high tenant need.

3. Diverse Property Alternatives:

From high-end condos and historical brownstones in Manhattan to waterfront homes in the Finger Lakes, New York State supplies a vast array of residential or commercial property kinds to fit different financial investment strategies. Whether you want urban redevelopment projects or trip leasings in breathtaking locations, there's an financial investment chance to match your objectives.

Secret Areas for Real Estate Financial Investment in New York State

1. New York City:

As a international financial and cultural center, New York City continues to be one of the most desirable realty markets worldwide. Neighborhoods like Manhattan's Upper East Side, Brooklyn's Williamsburg, and Queens' Long Island City deal possibilities for luxury condos, business homes, and mixed-use growths.

2. Hudson Valley:

The Hudson Valley region, understood for its attractive landscapes and historical towns, draws in homeowners and travelers alike. Cities like Poughkeepsie, Kingston, and Beacon supply chances for domestic financial investments, vineyard estates, and hospitality ventures satisfying site visitors from nearby metropolitan areas.

3. Long Island:

Long Island's distance to New york city City, beautiful beaches, and upscale neighborhoods make it a preferable property market. Capitalists can explore opportunities in upscale houses, beachfront estates, and business growths along the island's vibrant coastal towns.

4. Upstate New York:

Upstate New York encompasses regions such as the Finger Lakes, Adirondacks, and Funding Region, each offering unique investment prospects. From vacation homes in the Finger Lakes to tech industry growth in Albany, investors can profit from cost, picturesque appeal, and financial advancement outside of major metropolitan areas.

5. Western New York:

Cities like Buffalo, Rochester, and Syracuse in Western New york city are experiencing revitalization and development in fields such as medical care, education and learning, and innovation. Financiers can think about homes, mixed-use developments, and flexible reuse tasks in these arising metropolitan centers.

Tips for Successful Property Financial Investment in New York State

1. Understand Local Market Trends:

Research market fads, market shifts, and economic indications influencing your target region. Stay educated regarding regional laws, zoning laws, and growth jobs that could influence building worths and investment returns.

2. Construct a Network of Professionals:

Get in touch with regional property agents, property supervisors, attorneys, and economic advisors that specialize in New york city State's realty market. Their competence and insights can lead your investment choices and navigate intricate deals.

3. Expand Your Profile:

Diversify your financial investments across various home types, places, and market sectors to spread risk and maximize returns. Consider a mix of household, commercial, and friendliness residential or commercial properties based upon your risk resistance and financial investment objectives.

4. Examine Financing Options:

Explore financing alternatives tailored to realty financial investments, such as conventional home loans, business car loans, and collaborations with various other investors. Contrast rate of interest, terms, and costs to maximize your financing method and boost cash flow.

5. Plan for Long-Term Growth:

Establish a critical investment strategy straightened with your economic goals and time perspective. Monitor market conditions, residential property efficiency, and tenant demographics to adapt your method and maximize possibilities for long-term growth and success.

Purchasing realty in New york city State supplies capitalists a varied range of opportunities across its dynamic markets. Whether you're attracted to the fast-paced environment of New York City or the peaceful landscapes of the Hudson Valley, tactical investments can generate considerable returns and long-lasting riches build-up. By comprehending market patterns, leveraging regional Real Estate Investment New York competence, and diversifying your portfolio, you can navigate New York State's real estate landscape with confidence and success.

Start your property financial investment trip in New york city State today and unlock the potential for monetary development and profile diversity in one of the nation's most resilient and gratifying markets.

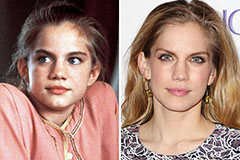

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!